What if you could build your credit score by simply paying your rent on time every month?

Rent reporting is a growing way for renters—especially students and young adults—to build credit by having on-time rent payments reported to major credit bureaus. At Sweetwater, this service is provided through UpCredit.

In this article, we’ll explain what rent reporting is, how it works, and why it matters, particularly for renters who are just starting to build their credit history. We’ll also touch on how Sweetwater provides this service for residents at Sweetwater.

What Is Rent Reporting?

Photo courtesy of upcredit.us

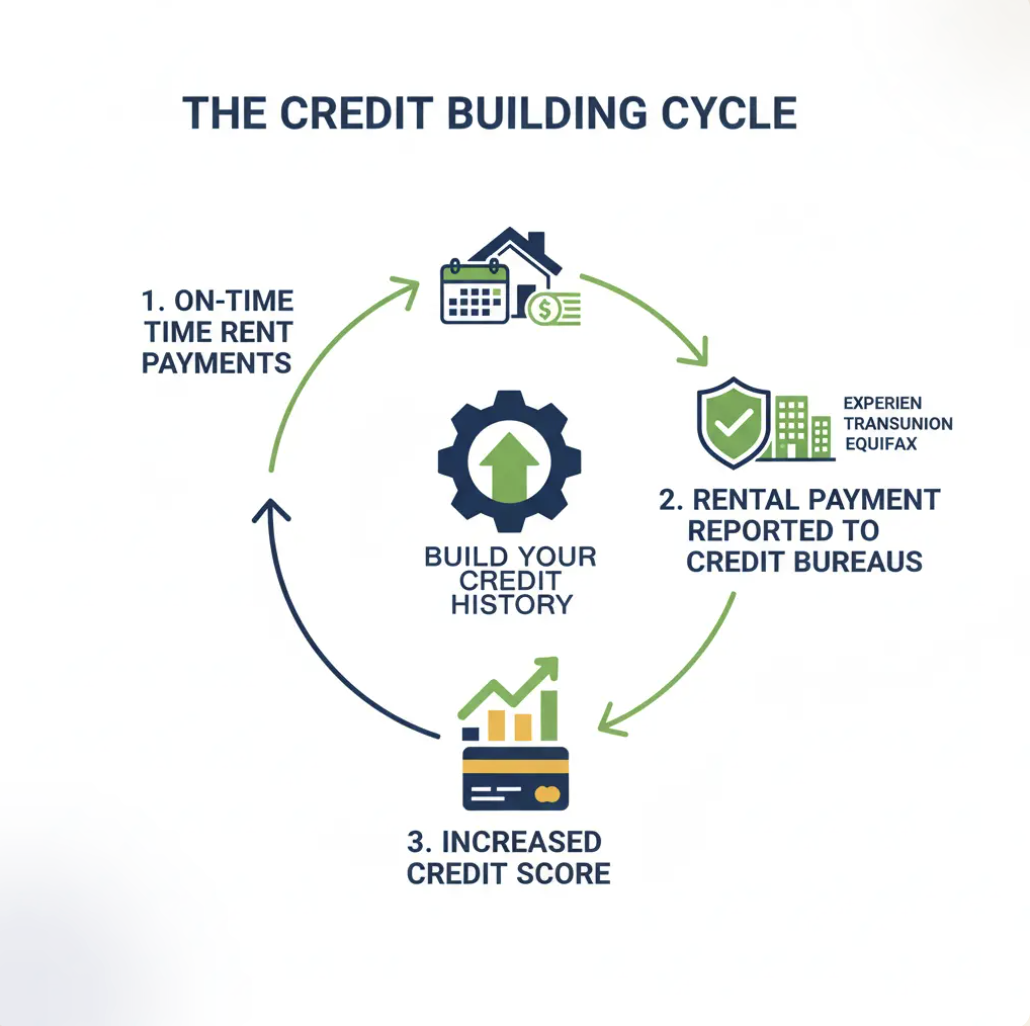

Rent reporting is a way to include your monthly rent payments in your credit history by reporting them to major credit bureaus like Experian, TransUnion and Equifax. Services like UpCredit help facilitate this process by verifying and reporting on-time rent payments.

When your rent is reported, it becomes part of your official credit record, similar to how credit card or car loan payments are recorded. Because rent is often a renter’s largest monthly expense, reporting on-time payments can help demonstrate consistent, responsible payment behavior over time.

Why Rent Reporting Matters

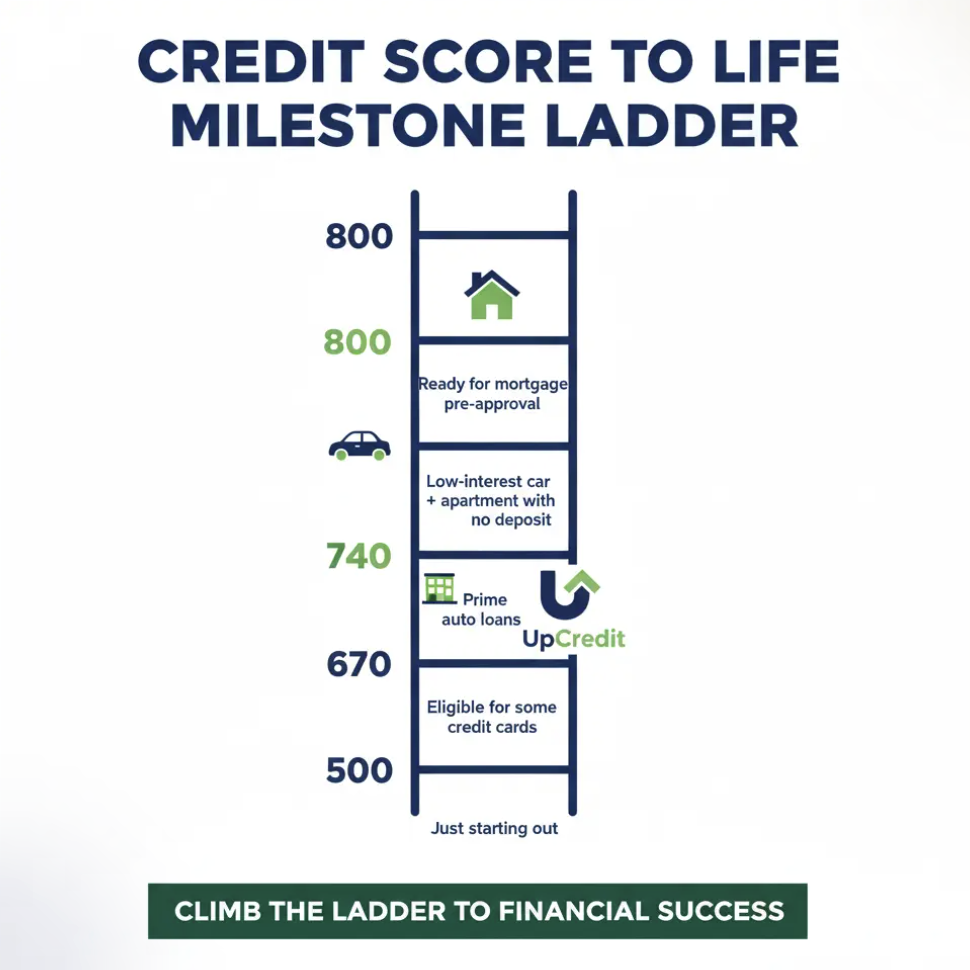

Many students and young renters begin with little or no credit history. Without established credit accounts, it can be more difficult to:

- Qualify for credit cards

- Get approved for future apartments

- Finance a car or home

- Secure lower interest rates

Rent reporting helps bridge this gap by adding on-time rent payments to your credit history. This allows the rent you already pay each month to help show lenders and housing providers that you are a reliable payer when it comes time to apply for credit or housing.

How Rent Reporting Builds Credit

Photo courtesy of upcredit.us

Rent reporting is effective because it focuses on payment behavior, the single most important factor in most credit scoring models. Instead of relying on credit cards or loans, rent reporting uses payments you already make each month to help build credit.

Key benefits include:

- On-time payments build history. Your credit score is based largely on payment behavior, not income.

- Rent appears on your credit report. Reported rent payments help establish or strengthen your credit profile over time.

- No new debt required. Unlike credit cards or loans, rent reporting does not increase your credit utilization.

- Automatic reporting. When rent is paid on time, easily accomplished through autopay, payments are verified and reported automatically, with no extra apps, steps or ongoing effort required.

This makes rent reporting a simple, set-it-and-forget-it way to build credit while paying rent as usual.

What Impact Can Rent Reporting Have?

Rent reporting can be especially helpful for people with limited or no credit history, but it can benefit anyone looking to strengthen their credit over time.

Photo courtesy of upcredit.us

By consistently paying rent on time, renters can build a positive payment history, which is the largest factor in most credit scoring models. Over time, this can help establish or strengthen a credit profile and support future applications for credit or housing.

Payment history accounts for approximately 35% of a credit score, and every on-time rent payment helps reinforce that history.

UpCredit Rent Reporting at Sweetwater

Sweetwater offers rent reporting through UpCredit for $9 per month, making it a simple way to start building credit using rent you already pay. This option helps residents build credit without opening new credit cards or taking on additional debt.

If you want to learn more about how rent reporting works at Sweetwater, including enrollment details and what to expect, check out our Rent Reporting FAQ section. If you still have questions or need help with your account, contact the Sweetwater leasing team for assistance.